Introduction

In today's dynamic business landscape, managing payroll efficiently is crucial for any organization's success. With the advent of advanced technology, payroll processing has undergone a significant transformation, making it more seamless and error-free than ever before. Among the plethora of payroll solutions available, Zoyo Payroll stands out as a reliable and innovative tool designed to streamline payroll processes and enhance overall efficiency. Let's delve deeper into how Zoyo Payroll can revolutionize your payroll management system.

Computerized Payroll Technique

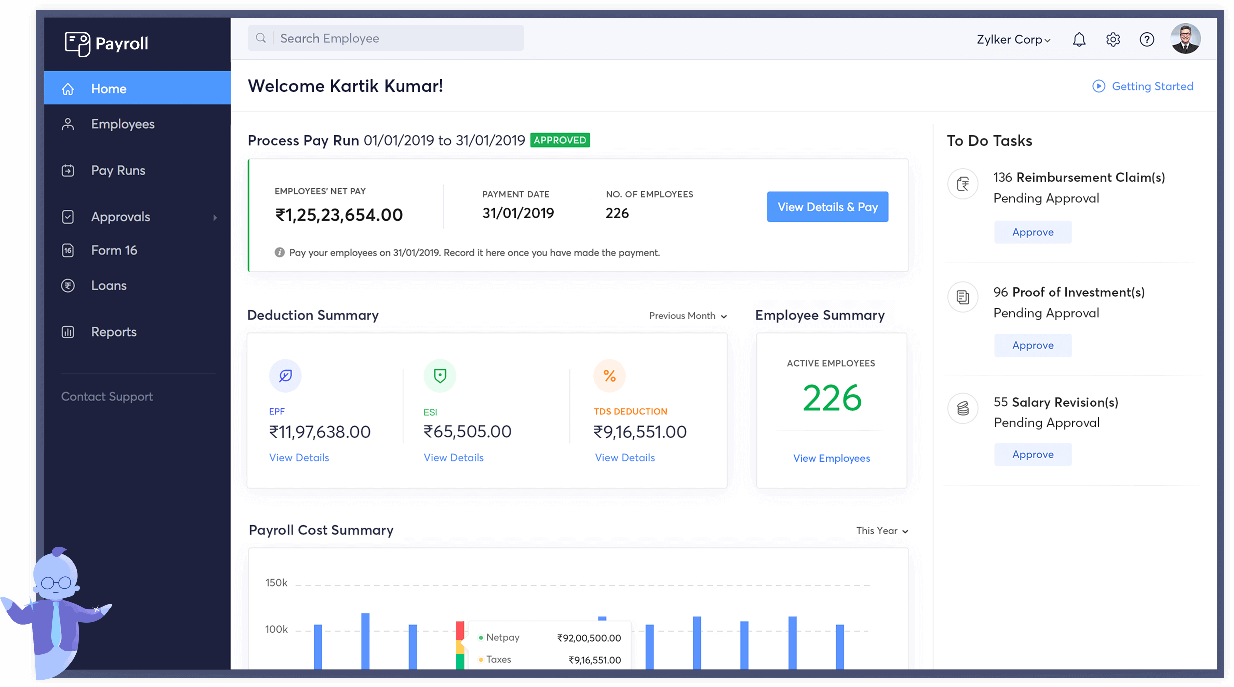

Gone are the days of manual payroll calculations fraught with errors and inefficiencies. Zoyo Payroll automates the entire payroll process, from calculating salaries and deductions to generating tax forms and reports. By leveraging advanced algorithms and data analytics, Zoyo Payroll ensures accuracy and consistency in payroll processing, saving HR personnel valuable time and effort.

Compliance Made Easy Adhering to Regulations

Empowering employees to manage their payroll information can significantly reduce administrative overhead and enhance employee satisfaction. With Zoyo Payroll's self-service portals, employees can access their pay stubs, tax forms, and benefits information conveniently. They can also update personal information and submit time-off requests, reducing the burden on HR personnel and fostering a culture of transparency and accountability within the organization.

Employee Self-Service Portals

In today's interconnected world, seamless integration between different systems is essential for optimal business operations. Zoyo Payroll offers robust integration capabilities, allowing it to sync seamlessly with other HR and accounting software platforms. Whether you're using an enterprise resource planning (ERP) system, time and attendance software, or employee management tools, Zoyo Payroll can integrate effortlessly, eliminating the need for manual data transfer and ensuring data consistency across various platforms. This integration not only streamlines processes but also enhances overall productivity and data accuracy.

Enhanced Compliance

Empowering employees to manage their payroll information can significantly reduce administrative overhead and enhance employee satisfaction. Zoyo Payroll offers self-service portals that enable employees to access their payroll-related information conveniently. From viewing pay more info stubs and tax forms to updating personal information and submitting time-off requests, employees can take control of their payroll-related tasks, thereby reducing the burden on HR personnel. This self-service functionality fosters transparency and accountability while fostering a culture of empowerment within the organization.

Expandability and Workability

As businesses grow and evolve, so do their payroll needs. Zoyo Payroll offers scalability and flexibility to adapt to changing requirements seamlessly. Whether it's expanding the workforce, opening new locations, or introducing complex payroll structures, Zoyo Payroll can accommodate these changes with ease, ensuring that it remains a reliable payroll solution regardless of the organization's size or industry.

Protecting Sensitive Information

Protecting sensitive payroll information is paramount in today's digital age. Zoyo Payroll prioritizes data security and employs robust measures to safeguard payroll data from unauthorized access, breaches, or cyber threats. With features such as encryption, multi-factor authentication, and regular security updates, Zoyo Payroll provides peace of mind knowing that your payroll data is safe and secure.

Conclusion

In conclusion, Zoyo Payroll is a game-changer for organizations looking to maximize efficiency and streamline payroll operations. With its advanced features, seamless integration, and commitment to compliance and security, Zoyo Payroll empowers organizations to focus on strategic initiatives and drive business growth.